Creating A World Without Poverty: Turning The Poor into Entrepreneurs!

Extreme Poverty in the World

Today over 1 billion people in the world live on less than $1.25-a-day, forming about 18 percent of the humanity, according to the recent World Bank’s estimates. $1.25-a-day is Bank’s yardstick of extreme poverty; it is derived from the average poverty lines in the world's poorest nations. It has set the goal of ending extreme poverty by 2030 (ie. bringing global poverty to 3 percent by 2030) and in order to achieve that it wants to reduce it to 9 percent by 2020. The World Bank also aims to boost the incomes of the poorest 40 percent so that they don’t fall again into poverty.

To put things in perspective, in 1990 43 percent (or 1.91 billion) people in developing countries lived in extreme poverty; they were 52 percent (1.94 billion) in 1981. This number has fallen to 1.2 billion in 2010 – so the MDG target of halving the poverty percentage by 2015 was already achieved in 2010. At the current rate of progress about 1 billion would be in extreme poverty in 2015. Reducing it to 9 percent means about 690 million people would be still living in extreme poverty in 2020.

The story is not that inspiring if we consider the $2-a-day poverty line. About 2.4 billion people lived on less than $2-a-day in 2010 which is only a modest decline from 2.59 billion in 1981. It is not difficult to imagine that almost half of the humanity would be living below $3-a-day. These statistical numbers are obviously blind towards the hardships poor people constantly live with, so we have to go beyond these numbers to get the glimpse of the enormity of human suffering. For instance, over 50,000 poverty deaths occur daily worldwide, almost 800 million people go to bed hungry every night and more than 10 million children die of hunger and preventable diseases annually. There are many other disadvantages in the lives of poor that can't be measured in numbers. Their biggest handicap is the situation of disempowerment - lack of voice and choices.

Millions Live in Extreme Poverty in the US!

It sounds unbelievable but a study in 2011 revealed that 1.65 million US households were forced to live below the $2-a-day per person in a given month. It included 3.55 million children.

Why So Much Poverty in the World

In the past decades, several trillion dollars have been given to the poor nations for programs targeted at the poor. The World Bank and the United Nations have been running their own anti-poverty programs in the poor countries. There is target oriented global intervention in the form of the Millennium Development Goals (MDGs) set to expire in 2015 and further programs are being chalked out for beyond 2015.

Talking of economic development, there is wide gap between the rich and the poor and the divide appears to be only widening with time. It implies that access to good education, quality healthcare, electricity, safe drinking water and sanitation etc is still elusive for the poor of the developing countries. They are also particularly vulnerable to economic shocks, food shortage and climate change which threatens to undermine development of the recent decades.

Despite the worldwide focus on poverty, welfare programs, countless charitable organizations and governmental anti-poverty programs across the world there appears to be rather limited impact on the extent of global poverty. Why?

Most welfare or anti-poverty programs focus on ‘giving’ something to the poor - and the poor receive the benefits because they ‘qualify’ for it. Once started, the welfare programs can’t be stopped (for obvious political and humanitarian reasons) particularly as long as there are poor who ‘qualify’ as recipients. This necessitates perpetuation of the welfare programs which leads to institutionalization of the welfare setup to keep the system running. Then more and more money goes to feed the anti-poverty bureaucratic machinery than what gets into the hands of the intended poor. Such a system sustains poverty rather than eradicates it because it only address the short term needs, such as food or medical care. As a result, the poor remain where they are – in poverty – and yet the programs keep running year after year!

Meanwhile, the constant flow of funds into the system attracts corruption leading to diversion of funds into wrong directions. This further deprives the poor beneficiaries. Poor countries are also poorly governed, making them highly prone to corruption and siphoning of funds. As a result, it becomes nearly impossible for the poor or average citizens to receive proper government services. The end result is that very little reaches the targeted people, negating the efforts of those trying to eradicate poverty.

Exclusion of Poor People

It is a widely known fact that the socio-economic dynamics works against the poor – they get pushed to the sidelines and become excluded from the mainstream social, political and financial processes. Once they are marginalized the situation becomes conducive for growth of poverty. It is a rut from which few ever come out on their own without outside support. Every 'shock' only pushes them further deep into poverty and they find themselves selling whatever meager assets they still managed to hold on to. The mainstream formal banking and financial sector have preference for upper end clients and their procedural requirements, particularly of collaterals, makes them beyond the reach of poor people. Moreover, small loans or credits are unviable due to procedural expenses involved. The local money lenders in the informal sector generally charge exorbitant interest rates besides employing exploitative tactics. Once in their trap, the poor often sink further deep in debt and poverty.

The failure of the formal and informal financial sectors to provide easy and affordable credit to the poor is often seen as among the main factors that reinforce the vicious socio-economic structures that end up promoting and sustaining poverty.

In an effort to address this failure, the idea of ‘microcredit’ or ‘microfinance’ has gained favor in recent decades. It essentially involves disbursing small collateral-free loans to the poor in order to foster income generation and poverty reduction through encouraging self-employment.

Portfolios of the Poor: How the World's Poor Live on $2 a Day

The Book Portfolios of the Poor: How the World's Poor Live on $2 a Day tries to find out how the poorest of the world manage to make both ends meet. It needs tremendous skills to survive and the poor might have highly sophisticated financial lives.

What is Microcredit

The terms microcredit, microfinance and microlending are often used interchangeably although researchers can easily point out various shades of meaning under different contexts. In past two decades, the word ‘microcredit’ has become a buzz word among the development people. To be sure, it can mean practically anything to anyone or everything to everybody.

However, in the context of this article the idea of microcredit is pointed out in the title and it certainly brings dignity and empowerment in the life of poor people. Rather than treating them as ‘helpless’ patients of the disease called poverty that can only be treated by "poverty experts" and the governments, microlending treats them as entrepreneurs who wants to take charge of their life with their own efforts. The idea is to help poor people with small loans so that they can start and setup businesses. They save money and payback the loan over time. The idea behind microfinance is to empower the borrowers by helping them build a business which can create income and grows in the years to come. It enables poor people save and work towards ultimately becoming part of the mainstream financial system of the country.

Two well-known examples from recent decades, both from Bangladesh, serve to underscore the potential of microlending as a workable anti-poverty tool. In the late 1950s, Akhtar Hameed Khan began experimenting with microcredit in the poor areas of Pakistan. His efforts grew to later become the Bangladesh Academy for Rural Development (BARD). Then in mid 1970s, Dr Muhammad Yunus started serious experimentation with microcredit which earned him Nobel in 2006. His venture Grameen Bank (It literally means ‘village bank’) became an important milestone for the modern-day microcredit movement. It has now blossomed into a global phenomenon penetrating into more than 130 countries (including the super rich US) across the world in the last 2 decades.

The reason why these initiatives succeeded is creation of ‘trust’ between the borrowers and the lender which ensures over 99 percent loan recovery and keeps the borrowers connected with the lending institutions. The microledning institutions rejected the very line of thinking of the formal banking sector that makes the poor ‘credit unworthy’ and worked their way through building ‘trust.’

What is Microfinance?

Microcredit and Islamic Fundamentalists

Q. Why Islamic Fundamentalists went against the Grameen Bank in Bangladesh?

A. They feared it empowers women which goes against the male dominance in the society.

The Grameen Bank of Bangladesh

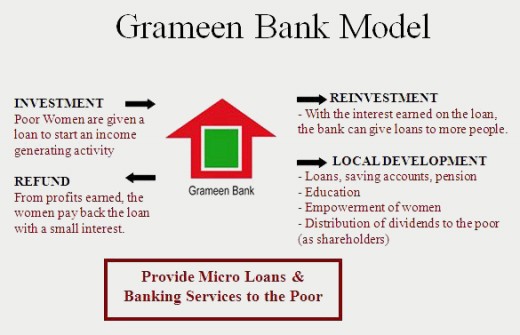

The idea of Grameen Bank evolved from a research project aimed at identifying the causes of poverty. Professor Muhammad Yunus noted that capital constraint was compelling rural women folks to sell their handicraft products to raw material providers at prices much below the market prices. He concluded that lack of access to small-scale capital in rural areas was preventing the poor from generating better income. Thus, he decided to help the poor through small credits without collateral.

Needless to say, the success of any lending program depends upon recovery of the loans. This applies to microcredit also. This has to be a straightforward system and without coercive means employed by the informal lenders. In order to achieve this, the Grameen Bank pioneered the concept of ‘group-lending’. In this model, a group is formed of people with similar socio-economic status (and generally from the same village or local area). Each member acts as a guarantor of loans of other group-members. This system of “joint liability” replaces the traditional collateral system of the formal financial sector. If any member defaults the whole group becomes ineligible to receive additional loans. In this sense, each member of the group is responsible and liable for other members’ repayment of loans.

An important contribution of Muhammad Yunus has been his innovations in credit contracts that made the poor bankable. Innovations like joint liability, peer-monitoring, and dynamic incentives have helped overcome the barriers that traditionally denied access of the poor to credit. These efforts have fostered a degree of financial inclusiveness that did not exist before. The idea of microcredit as an effective anti-poverty tool is now widely accepted throughout the world.

What Lies Behind the Success of Grameen Bank

The thinking that catalyzed the success of the Grameen Bank firmly believed that the poverty is not created by the poor; it is created by the institutions controlling the flow of money and their policies. Therefore, what is really needed to change the situation is appropriate changes in the policies of the financial sector to make them poor friendly. It also believes that charity is not an answer to poverty; charity only sustains poverty. It creates dependency and takes away individual's initiative needed to break the clutches of poverty. Unleashing people’s energy and creativity is the only correct and sustainable antidote of poverty.

The Grameen Bank brought credit to the door-steps of the poor – people who normally lack courage to enter the doors of the formal banking institutions and know precious little about modern ways of managing money. It created its operational methodology around the financial needs of the poor and provided them access to credit on reasonable term; thus, enabling the poor to put their skills to better use and earn a better income in each subsequent loans.

How the Grameen Bank Works

Fighting Multidimensional Poverty

Along with mcrofinance what else will further help the poor?

Read More

Can Microcredit Really Eradicate Poverty?

Despite the phenomenal popularity of microcredit in recent decades, experts are divided on efficacy of microlending as an anti-poverty tool. There are poverty researchers who are skeptical about microcredit as an effective anti-poverty measure, despite the narration of positive experiences from around the world. In making their argument they point to the widespread persistence of poverty across the globe. However, there is general agreement that it reduces vulnerability – access to microcredit has been shown to buttress crisis-coping mechanisms, create diverse income sources, build assets and empower women.

Since researchers often look at things under well defined and rigid framework of assumptions and parameters they are perplexed when ground realities don’t follow their model. Poverty is clearly a complex and multidimensional problem affected by numerous factors coming from culture, traditions, history, social structure, gender, nature and state of market conditions, state policies, and so on. These factors are different in different societies. In some societies people are traditionally more enterprising and think in terms of helping themselves while in others they look to state for everything. Clearly the skills to manage a micro-enterprise differ among people of different countries and even among the poor of any single society. Moreover, success in any business (no matter how small it is) depends a lot upon the socio-economic environment around people – after all entrepreneurship depends heavily on the surrounding market dynamics.

In fact, effective poverty removal needs broad based sustained economic growth, competitive but fair market conditions, public investment in physical and social infrastructure, and easy access to credit from banking sector.

Therefore, it is unrealistic to expect that the tiny amounts of credits given to poor who are underfed, lack knowledge and social contacts and live in substandard conditions can perform the miracle of poverty eradication.

In order to see the role of microcredit more clearly in the lives of poor people let us see what assets they generally posses.

What Do the Poor Own?

How well the poor are able to manage their lives depends upon the assets they own or have access to at the household, community or supra-community levels.

At the community level, their assets are public transport, communication system and access to schools and health services as well as water and sanitation etc. At the supra-community level, there may be legally protected rights (say food or health security) and freedoms that govern their extent of participation in the social and political processes affecting their lives. People in different societies and nations have access to these assets to different extents.

As far as microcredit is concerned, while its efficacy certainly depends upon market conditions and economic policies it operates at the individual or household level by creating new assets or managing the existing assets more productively. Having discarded as ‘unbankable’ by the formal banking sector, if microcredit is available it helps them harness their ‘human asset’ in the form of labor or skills and manage their lives in a better way.

Even if a poor is unable to create much wealth from the microcredit in the form of a sustainable business, having access to credit obviates the need for selling existing insufficient assets to manage sudden expenses. This surely provides some flexibility and reduces vulnerability to sudden shocks. This itself is not a mean achievement, giving the conditions the poor live in.

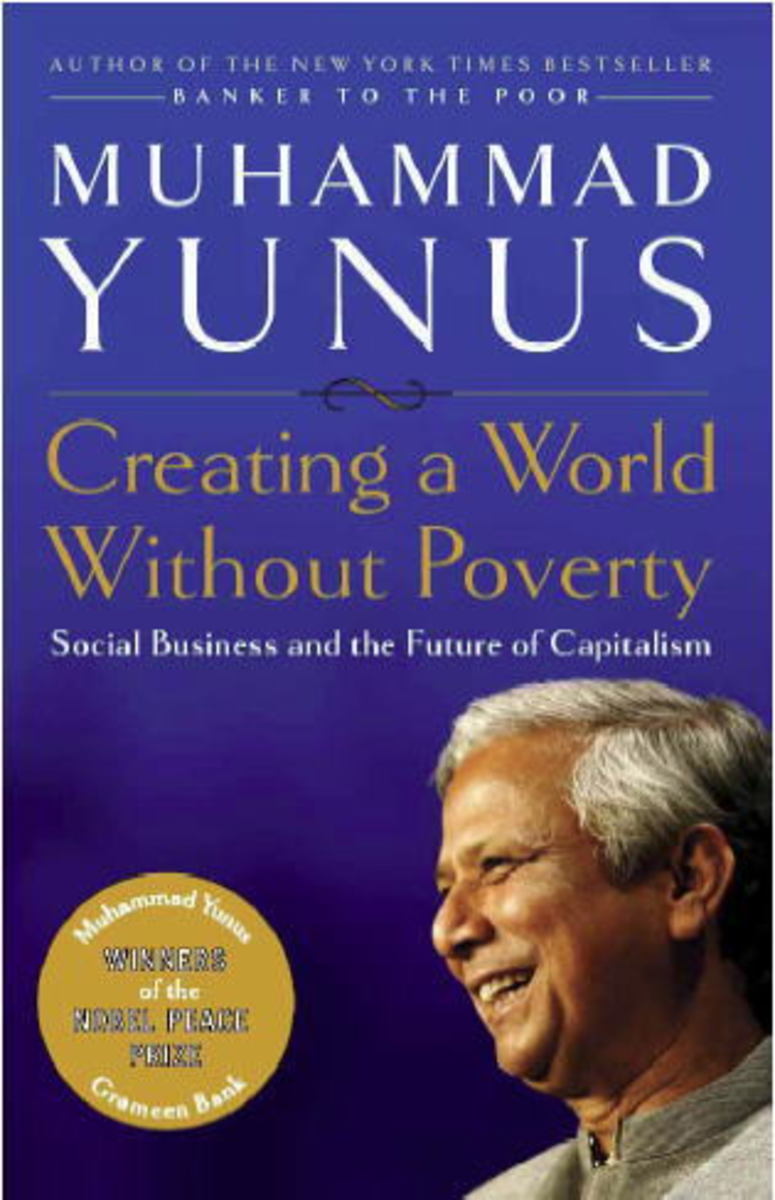

Dr Muhammad Yunus – Father of Modern Microcredit

'By giving poor people the power to help themselves, Dr. Yunus has offered them something far more valuable than a plate of food security in its most fundamental form. - Jimmy Carter, Former US President

'Muhammad Yunus is a practical visionary who has improved the lives of millions of people in his native Bangladesh and elsewhere in the world.' – Los Angeles Times

Dr Muhammad Yunus, the winner of Nobel peace prize in 2006, is now a globally known figure for his efforts to make free-market work for the poor through what is now widely known as ‘microcredit.’ His ideas created the Grameen Bank which inspired the development circle across the world to adopt its techniques and philosophy. But microcredit is not the only contribution, Dr Yunus has also pioneered the idea of Gram Sarkar (a form of participatory local governance by rural people) and Tebhaga Khamar (a system of cooperative three-share farming). These ideas were later adopted by the Bangladesh Government.

His microcredit initiative through the Grameen Bank primarily focuses on women and helps them build small businesses and lift their families out of poverty. In 2010, Dr Yunus noted: “Female borrowers brought much more benefit to their families than male borrowers. Children immediately benefited from the income of their mothers.”

Social Business

Recently Dr Yunus has floated the idea of ‘social business’ in his two books:

Creating a world without poverty: Social Business and the future of capitalism and

Building Social Business: The new kind of capitalism that serves humanity's most pressing needs.

Dr Yunus feels that today capitalism is too narrowly defined by focusing solely on individual profits, ignoring all other aspects of life. This he sees as the reason behind all wide ranging global problems: from poverty to environmental problems and poor health to illiteracy. He visualizes a world where the current profit-focused enterprises can coexist alongside social-benefit focused initiatives. He sees the social enterprises to run precisely on the line of efficient profit-maximizing entities. In fact, his social business model is nothing but a more humane form of capitalism with focus on societal issues besides making money.

Thus, a social business is cause-driven while pursuing sustainability through profit-making to recover its costs. The investors or owners of a social business gradually recover their money invested, but nothing beyond that. After that the company stays with its profits and expands or improves like any other enterprise; its work-force gets market wages but work with an attitude that is not profit-driven. They are driven to achieve a social or environmental cause through profit making enterprise and not personal monetary gains. In this sense, a social business is similar to a business-pursuing NGO.

Dr Yunus envisages two types of social enterprises: One, focused on social objective only; for example, it produces products for the benefit of the poor such as food supplements or nutritious food for poor pregnant women and children. Two, it may be owned by the poor and disadvantaged who share all the profits. Such an entity can produce any product or take up any business that is profitable.

You can become a Banker to the Poor!

- Poverty Overview

The World Bank’s efforts to fight global poverty is outlined here. - How Microfinance Really Works?

Microlending has been sold as a practical means to get capital into the hands of poor entrepreneurs so that they can earn their way out of poverty.